Stax Payments Review

Stax Payments is a credit card processing service that specializes in providing comprehensive payment solutions tailored to businesses of various sizes.

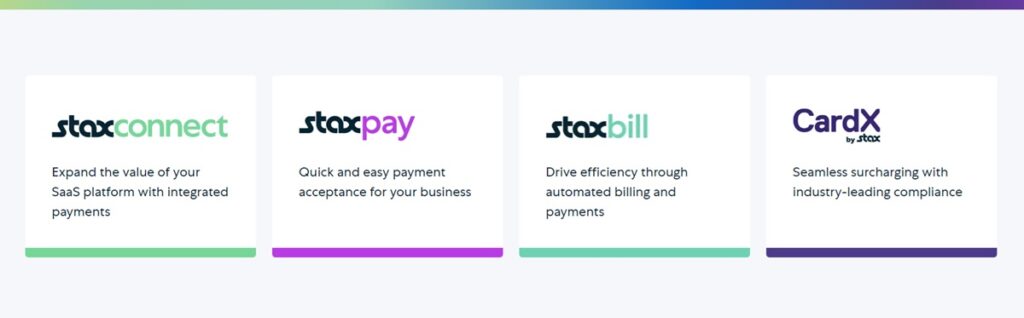

Alongside Stax Payments Pay, designed for small businesses, the company offers a range of payment services catering to enterprises, Software as a Service companies, and specific industries such as professional services, retail healthcare and field services.

Among its suite of payment products, this company offers CardX byStax Payments, specifically addressing surcharging compliance requirements. The company also offers Stax Payments Connect, which facilitates integrated payments, streamlining transactions for enhanced efficiency.

There is also Stax Payments Bill, which offers billing and invoicing solutions, simplifying the payment process for businesses and their clients. Interested in learning more about this company? If so, continue reading.

A Look at the Company’s Subscription Model

I will kick this review off by telling you that Stax Payments operates on a flat-rate subscription model. This model doesn’t entail any markup, except for a nominal fee of $0.08 per transaction, on the direct-cost interchange fee imposed by payment networks like American Express, Master Card and Visa.

According to the company, this subscription model can result in significant savings of up to 40% on credit card processing costs for small businesses. However, it’s important to note that Stax Payments subscriptions start at $99 per month. As such, the benefits of this approach are most pronounced for merchants with high sales volumes, as they stand to realize greater savings relative to their subscription costs.

Ideal Features for Credit Card Processing

I was quite impressed by this company’s wide range of credit card processing features across all its plans. These features are carefully designed to streamline payment processes and enhance convenience for businesses and customers alike.

With Stax Payments, businesses can create and send digital invoices seamlessly, while also setting up recurring invoices for regular payments and scheduling transactions in advance to manage cash flow efficiently. Additionally, this company provides Text2Pay mobile payment options, enabling customers to make payments via text message, and website-hosted payment links for convenient online transactions.

Businesses can securely store customer credit card information for future use and benefit from automatic updates for stored credit cards to ensure smooth transactions. Moreover, Stax Payments simplifies the setup of one-click shopping carts, facilitating quick and effortless online purchases.

These features are integral to this company’s commitment to providing businesses with robust credit card processing solutions tailored to their various requirements.

A Look at the Terms of Subscription

Stax Payments subscriptions operate on a monthly billing cycle, automatically renewing at the end of each cycle under the existing terms unless canceled by the customer or by Fattmerchant, the parent company. You can manage renewals and cancellations conveniently through the online account management page or by reaching out to the parent company’s support staff.

It’s worth noting that the credit card processing services of this company do not come with a free trial and there is no money-back guarantee provided by the company.

This approach reflects the company’s commitment to providing transparent and consistent services to its customers, allowing businesses to make informed decisions based on their needs and preferences without the obligation of a trial period or refund policy.

How to Avail this Company’s Services

To begin the process of signing up for Stax Payments credit card processing services, navigate to the Stax Payments homepage and select either “Large Business” or “Small Business” at the top of the page. Then, click the “Get Started” button to proceed to the “Request a Demo” page.

To get started with this company’s credit card processing services, you will first need to describe your business operations by providing key information such as whether it is based in the U.S., its monthly credit card processing volume, as well as the business’s name and contact details.

Following this, Stax Payments will organize a call back from a sales representative who will provide a personalized demo and quote tailored to the specific needs of the business.

Once in contact with a representative from this company, businesses can proceed to apply for a merchant account, which facilitates streamlined payment processes, enabling the acceptance of various payment methods and effective cash flow management.

A Look at the Add-on Features

Stax Payments provides standout add-on features that offer additional customization options to tailor its plans according to specific business needs. Businesses can quickly establish an online store using the one-click shopping cart feature, or utilize another feature to sell gift cards online, enhancing customer engagement and revenue opportunities.

Additionally, this company offers brand customization tools for payments, receipts and invoices, allowing businesses to maintain a consistent brand identity across their payment processes.

Furthermore, add-on features such as surcharging and lower interchange rates for card-not-present payments are available, enabling businesses to effectively reduce the cost of payment processing. These unique add-on features empower businesses to optimize their payment solutions and enhance their overall operational efficiency.