NerdWallet Review

NerdWallet is a company that is dedicated to empowering consumers and small businesses by equipping them with the necessary information and tools to make informed financial decisions.

By signing up for this company’s offers, you can learn about your credit score, track it over time, and access valuable resources to enhance your understanding about finance.

Moreover, NerdWallet offers the convenience of importing financial transactions directly from users’ credit cards and banks. This feature enables users to effortlessly track their net worth and cash flow within the app, providing a comprehensive overview of their financial health.

With this company’s user-friendly interface and wealth of resources, users can navigate their financial journey with confidence and clarity. Read this review further to learn how signing up for this company’s offers could benefit you.

Offering a Seamless Experience to Users

NerdWallet is a free platform that sustains itself through targeted recommendations for financial products such as mortgages and credit cards. Despite this, the advertisements on the platform are unobtrusive, ensuring a seamless user experience.

With its clear and intuitive interface, this platform stands out as one of the top personal finance apps available out there. Its user-friendly design makes managing finances straightforward and accessible, making it a valuable tool for individuals seeking to take control of their financial well-being.

An Easy Signup Process

Signing up for NerdWallet involves providing similar information as you would on other financial sites. Once you’ve decided to create an account, you’ll start by choosing a username and setting up a strong password for security. Following this, the app will prompt you to enter your contact information and Social Security number, necessary for accessing your credit information.

If you wish to include transactions from your credit cards and bank accounts, you’ll also need to verify your mobile phone number. This additional step helps ensure the security of your account and the accuracy of the financial data being imported into the app.

Overall, I was quite impressed by the sign-up process here, as it is incredibly straightforward and designed to efficiently gather the information needed to provide you with personalized financial insights and recommendations.

A Platform that Ensures Safety

NerdWallet prioritizes user security by implementing various industry-standard security measures. For instance, the platform supports multi-factor authentication, adding an extra layer of protection to user accounts. Additionally, it encrypts financial data using 128-bit encryption, further enhancing safety.

If you are someone who wants to connect their financial accounts and import transactions, NerdWallet utilizes trusted third-party platforms such as Yodlee and Plaid. These platforms have their own robust security protocols in place to ensure the safe transmission of data between NerdWallet and users’ banks.

If you seek more detailed information on NerdWallet’s security measures, I advise you to refer to the platform’s security page, which provides comprehensive insights into its security protocols and practices.

Offering Insights into your Credit Score

Once you provide NerdWallet with your Social Security number and optionally connect your financial accounts, you gain immediate insight into your financial status upon logging in, including your latest credit score. I really liked that this company doesn’t bombard you with financial product recommendations right away.

Instead, it offers a more balanced approach, providing access to supported products such as personal loans, credit cards, mortgages, auto loans, life insurance and whatnot, while allowing users to explore these options at their own pace.

This approach ensures that users can access valuable financial information and resources without feeling overwhelmed by product recommendations right from the beginning.

NerdWallet offers insight into the factors influencing your credit score. These factors, ranked from highest to lowest impact, include credit utilization, payment history, age and mix of accounts, balances, and recent inquiries.

Additionally, this platform features a credit simulator tool that allows users to explore the potential outcomes of specific actions, such as opening a new credit card or allowing accounts to go past due, on their credit score. This feature provides users with valuable insights into how their financial decisions may affect their creditworthiness.

Furthermore, users can access their full credit report through NerdWallet, a feature offered by competing apps as well. This comprehensive view of credit history enables users to track their financial progress and identify areas for improvement effectively.

Easy to Explore Dashboard

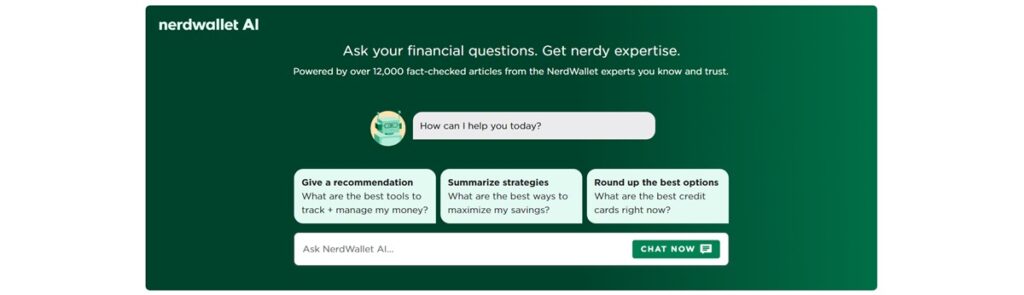

The dashboard provided by this company is quite concise compared to other personal finance apps, which often bombard users with excessive information, leading to confusion. When exploring this dashboard, you will find features like Weekly Insights, presenting users with a personalized set of cards containing suggestions for their weekly check-in.

Plus, you can view your credit score, get real-time net worth directly on the dashboard and do plenty more. Links to deeper details are provided for those seeking further information. This goes to show that NerdWallet goes above and beyond to ensure that its users can utilize its offerings without any troubles.