PayDiverse Review

PayDiverse specializes in meeting the specific requirements of high-risk merchants, offering tailored solutions to address their unique needs.

With fast payouts, this company ensures that merchants operating in high risk sectors can maintain optimal cash flow, a critical aspect of sustaining their businesses. Compatibility with popular platforms like WooCommerce, along with robust chargeback prevention tools, positions PayDiverse as a comprehensive and reliable choice for a large number of merchants from different parts of the globe.

I explored this company’s offerings to see if they could suit different types of businesses and was quite impressed. Want to find out what I found? If the answer is yes, please continue reading.

A Company that Understands What High Risk Merchants Want

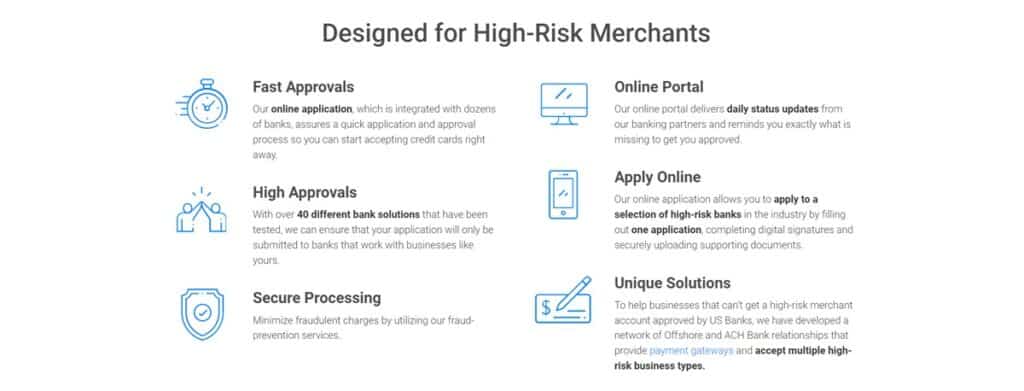

Utilizing its extensive experience as a high-risk merchant account provider, PayDiverse has successfully pinpointed recurring challenges in payment processing encountered by loads of high risk merchants. One common obstacle is the rejection of businesses categorized as high-risk by banks and merchant processors, creating hurdles in securing essential payment processing solutions. Additionally, merchants may face the frustrating scenario of being initially accepted by providers, only to have their accounts terminated shortly afterward, resulting in a loss of access to their funds and disrupting their business operations.

These challenges highlight the critical need for high-risk merchants to partner with a reliable provider like PayDiverse, equipped with the understanding and expertise to offer stable, long-term solutions tailored to their specific requirements.

Secure and Compatible Banks for High Risk Merchants

PayDiverse meticulously tests all of its partner banks to ensure compatibility with every high-risk industry type. When they set you up with a bank, you can trust that it has been thoroughly vetted and understands the nuances of your business as well as your expected processing performance. This meticulous approach guarantees that you receive a banking solution that is not only reliable but also tailored to meet the unique needs of your high-risk business.

It was also quite refreshing to see that this company prioritizes direct communication with its customers, adapting to their preferred communication style, whether it’s via phone, email or even text message. By engaging with customers on their terms, PayDiverse ensures effective and personalized communication, fostering stronger relationships and enhancing overall customer satisfaction. Whether you prefer traditional email correspondence, a quick phone call, or the convenience of text messaging, this company is more than dedicated to meeting your communication needs with flexibility and attentiveness.

Vast Network of Banks for High Risk Merchants

PayDiverse boasts one of the largest networks of high-risk banks out there, and the company’s network continues to expand. As mentioned earlier, they have conducted thorough testing on numerous processing banks to determine the perfect fit for every category of high-risk merchant account. Unlike loads of other providers in the industry, this one offer a diverse array of solutions tailored to each specific business type.

This extensive network and tailored approach ensure that PayDiverse can cater to the unique needs of high-risk merchants across various industries, providing them with reliable and effective payment processing solutions that meet their specific requirements.

Helping Merchants with Chargebacks

PayDiverse goes above and beyond to support high-risk merchants, particularly those in the CBD industry, in managing chargebacks and protecting their profits. Their multi-bank processing capabilities are a game-changer, helping merchants prevent high chargeback ratios. Another thing that sets PayDiverse apart is their proactive approach to chargeback management. With real-time, 24/7 chargeback alerts, CBD and other high risk merchants can swiftly address and analyze chargebacks as soon as they arise.

It is also worth mentioning here that the technology this company uses is adept at identifying vulnerabilities within merchant systems to minimize unjustified chargebacks. But it doesn’t stop there. PayDiverse provides merchants with the tools and support needed to dispute fraudulent or unwarranted chargebacks instantly. From start to finish, their team offers comprehensive assistance throughout the dispute process, ensuring merchants have the best chance of reclaiming their rightfully earned funds.

Seamless Application Process

PayDiverse offers a seamless solution for high risk businesses that are searching for reliable payment processing and robust fraud prevention tools. Their application process is straightforward and can be completed online, with approval typically granted within 24 hours. Once approved, merchants can expect to be up and running with full payment processing capabilities within just two days.

What sets PayDiverse apart is their dedication to providing comprehensive support and integrated fraud prevention measures. Upon approval, merchants receive access to a user-friendly online portal, where they can efficiently manage their accounts and monitor for any potential fraud or chargeback issues.

Final Thoughts

Overall, this company’s efficient onboarding process, quick approval times, and robust fraud prevention tools make them a standout choice for businesses in need of high-risk merchant account services. With PayDiverse, you can trust that your company’s payment processing needs will be met with professionalism and reliability.